Первый слайд презентации: Pre-Diploma Internship

Done by: Abilkhanova Zh.K., FIT, 4st year student Pre-Diploma Internship

Слайд 2

Contents Introduction Formulation of the problem Imitation model Results of modeling Conclusion References

Слайд 3

Theme of graduation work: “ Imitation modelling of evaluation investment attractiveness of the project ” Supervisor: Candidate of Technical Science, Associate Professor B.K.Kurmanov Externship firm: “ Kiit Consult” in Almaty Date of practice: From 12 January to 6 February

Слайд 4

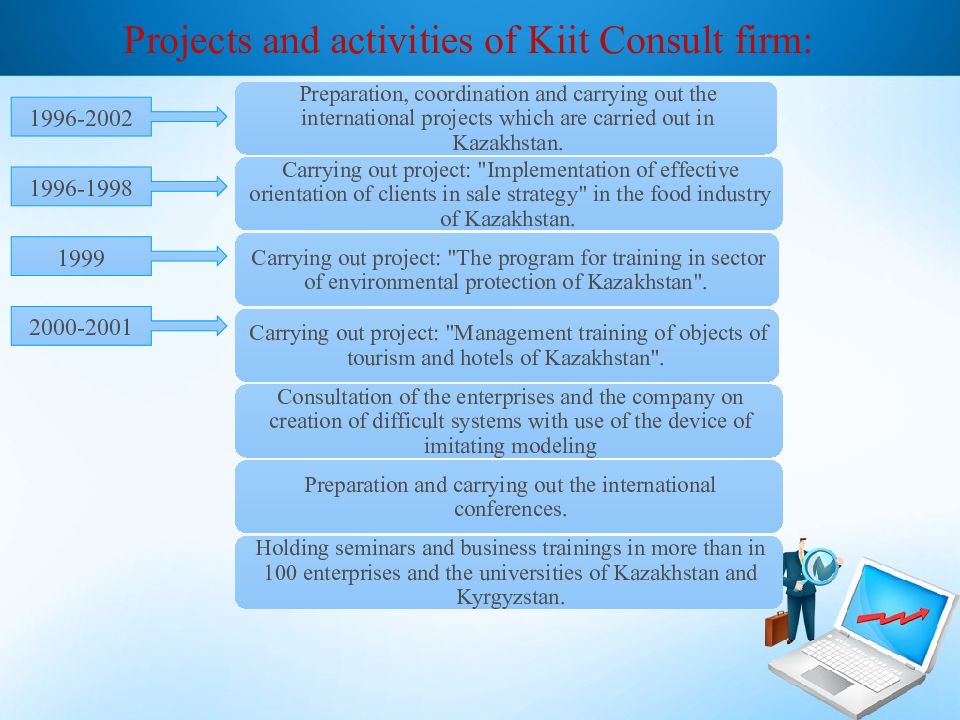

1996-2002 1996-1998 1999 2000-2001 Projects and activities of Kiit Consult firm:

Слайд 5: Formulation of the problem

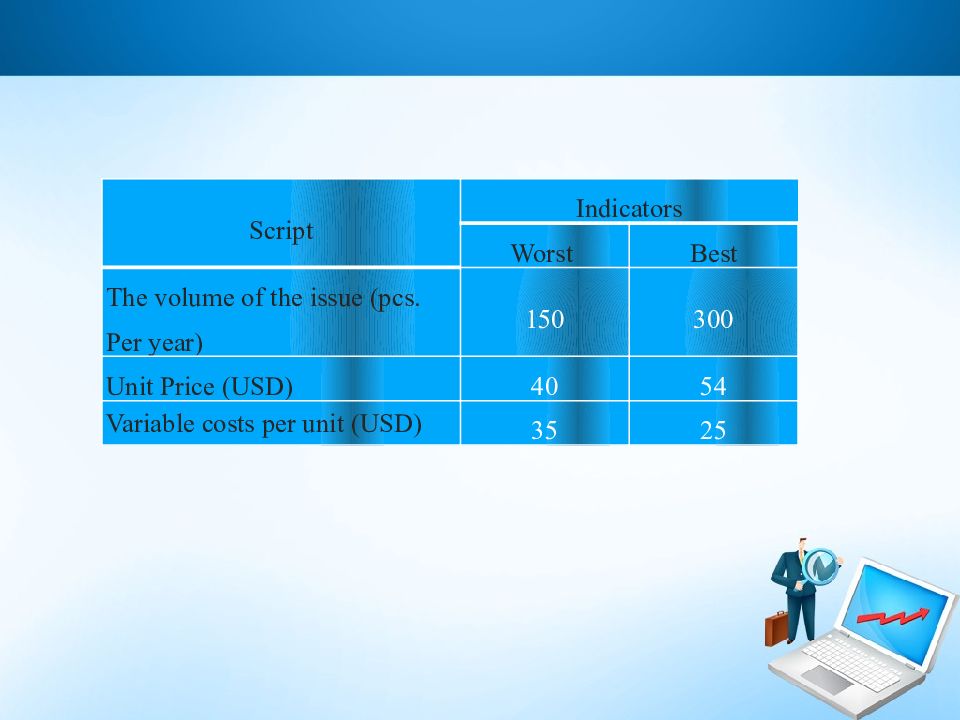

Some firms are considering an investment project for the production of a new product. During the preliminary analysis by experts identified three key parameters of the project and identifies possible limits of their changes.

Слайд 6

Script Indicators Worst Best The volume of the issue (pcs. Per year ) 150 300 Unit Price (USD) 40 54 Variable costs per unit (USD) 35 25

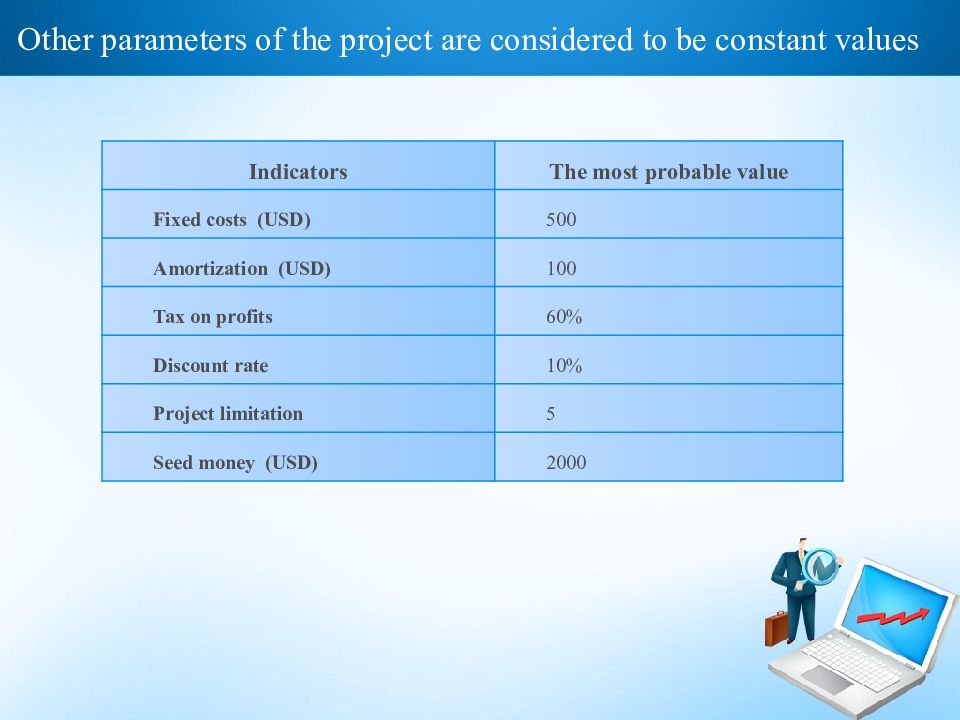

Слайд 7: Other parameters of the project are considered to be constant values

Indicators The most probable value Fixed costs (USD) 500 Amortization (USD) 100 Tax on profits 60% Discount rate 10% Project limitation 5 Seed money (USD) 2000

Слайд 8

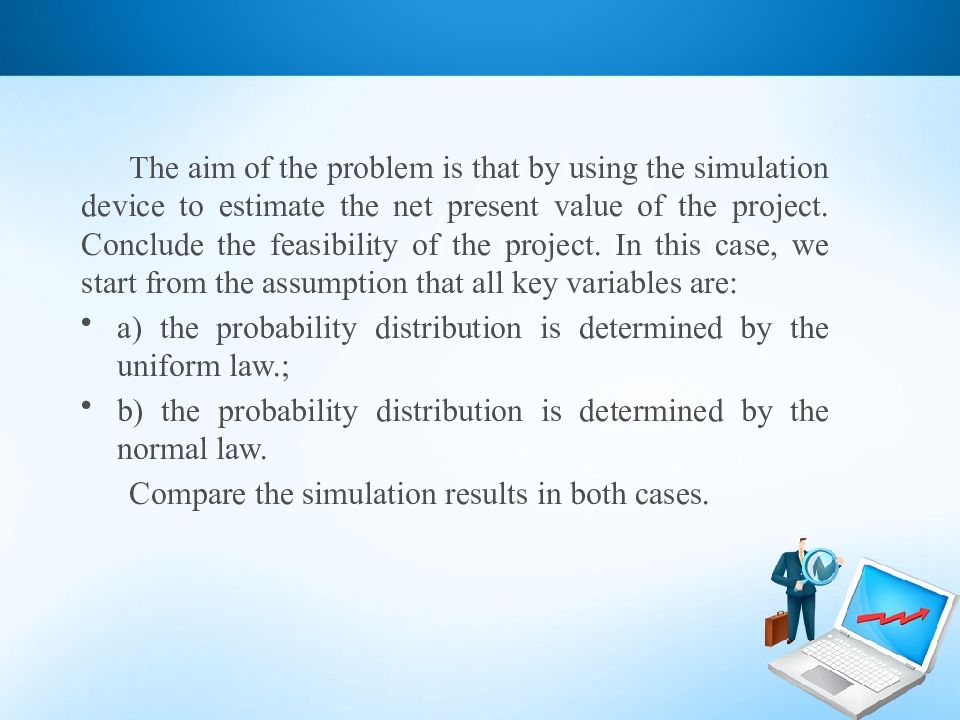

The aim of the problem is that by using the simulation device to estimate the net present value of the project. Conclude the feasibility of the project. In this case, we start from the assumption that all key variables are: a) the probability distribution is determined by the uniform law.; b) the probability distribution is determined by the normal law. Compare the simulation results in both cases.

Слайд 9

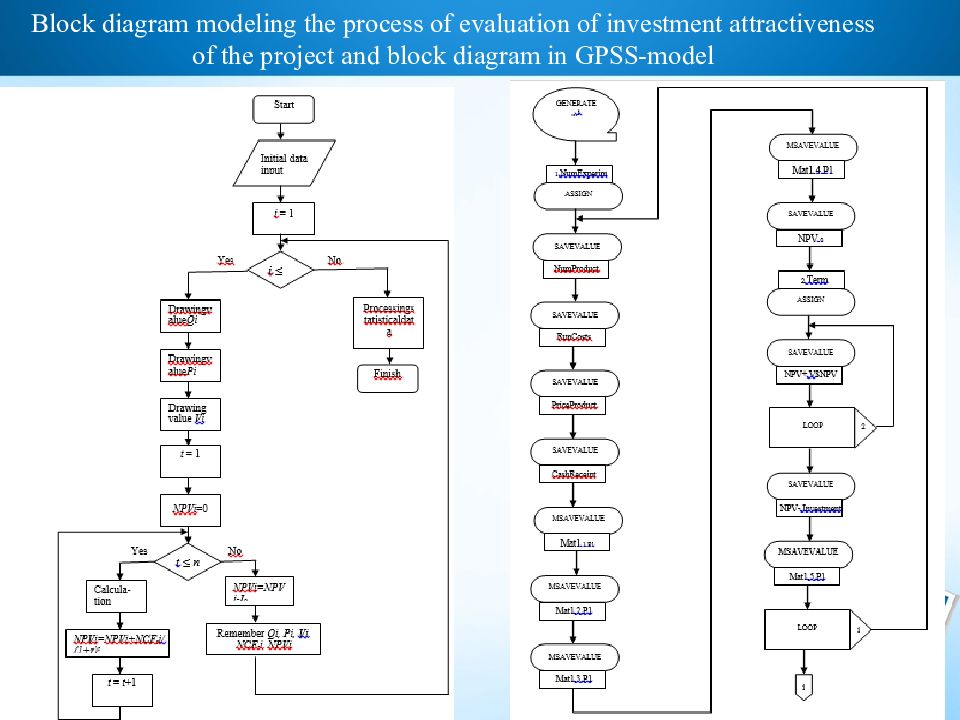

\ Block diagram modeling the process of evaluation of investment attractiveness of the project and block diagram in GPSS-model

Слайд 10

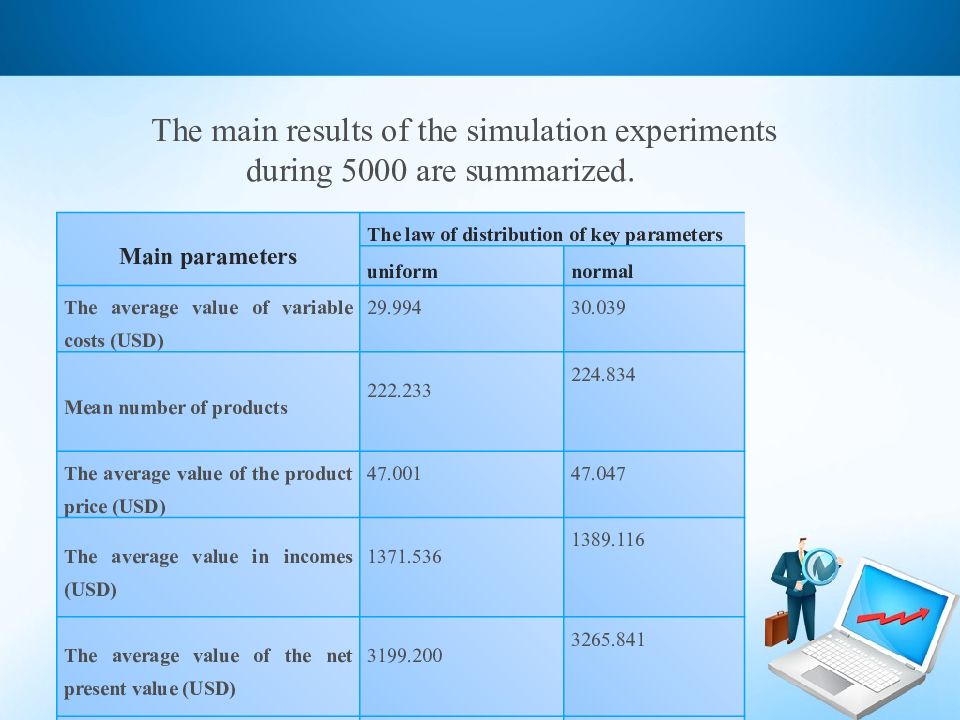

The main results of the simulation experiments during 5000 are summarized. Main parameters The law of distribution of key parameters uniform normal The average value of variable costs (USD) 29.994 30.039 Mean number of products 222.233 224.834 The average value of the product price (USD) 47.001 47.047 The average value in incomes (USD) 1371.536 1389.116 The average value of the net present value (USD) 3199.200 3265.841 The number of cases of negative NPV 243.000 221.000 The percentage of negative NPV 0.049 0.044

Слайд 11

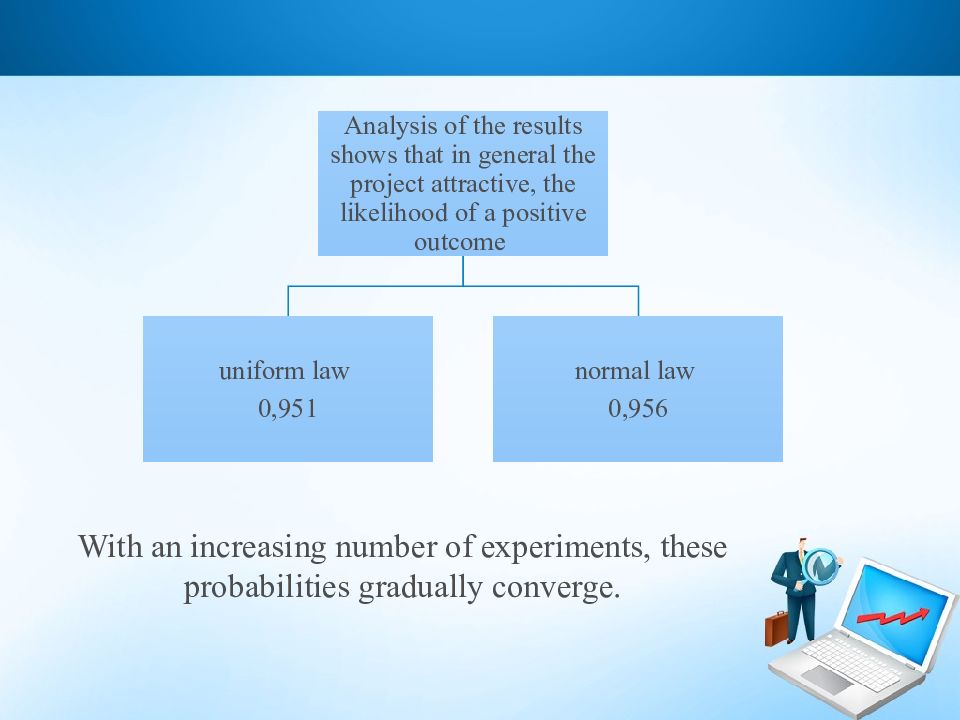

With an increasing number of experiments, these probabilities gradually converge.

Слайд 12

Conclusion A necessary condition for stable functioning and development of the economy is an effective investment policy, leading to an increase in production volumes, the growth of national income, the development of various industries and enterprises.

Слайд 13

The work presents a simulation model of the evaluation process, investment appeal of the project. The developed model is reduced to a software implementation, using the simulation system GPSS World.