Первый слайд презентации: SAMPLE

194 healthy male students (mean age +/ - s.d., 22.0 +/ - 3.4yr) From different universities in Zurich. In the trust experiment participated 128 people, and in the risk experiment – 66 subjects. Exclusion criteria for participation: significant medical or psychiatric illness, medication, smoking > than 15 cigarettes per day, and drug or alcohol abuse. Subjects were instructed to abstain from food and drink for 2 h before the experiment, from alcohol, smoking and caffeine for 24 h before the experiment. Participants were informed at the time of recruitment that the experiment would evaluate the effects of hormone on decision making.

Слайд 2: METHOD

Substance administration Subjects received a single intranasal dose of 24 IU oxytocin ( Syntocinon -Spray, Novartis; 3 puffs per nostril, each with 4 IU oxytocin ) or placebo 50 min before the trust or risk experiment. Subjects were randomly assigned to the oxytocin or placebo group (double-blind, placebo-controlled study design).

After substance administration, subjects completed questionnaires on a computer to measure demographic items and psychological characteristics. Subjects were asked to wait in the rest. During this 5 min participants were seated at different tables. Those who seat at the same table could talk to each other, but the at beginning of the experiment they were informed that they would not be interacting with those subjects who sat at the same table. When they reentered the lab, they received written instructions that explained the payoff structure of the experiment and the private payment procedure at the end.

Слайд 4: Cont’d

4. Subjects were randomly and anonymously assigned to the role of investor or trustee in the trust experiment, and did not know the identity of the persons with whom they were matched. 5. After subjects had read the instructions in each experiment, it was checked whether they understood the payoff structure by means of several hypothetical examples. 6. In addition, subjects received an oral summary of the instructions.

Слайд 5: PROCEDURE

Trust experiment Each subject made four decisions in the same player role while paired with different, randomly selected interaction partners. No pair of subjects interacted twice. Subjects in the role of the investor received no feedback about the trustee’s decision between the different interactions. After every transfer decision, each investor was asked about his belief with regard to the expected back transfer from the trustee.

Слайд 6: Cont’d

Risk experiment E verything was identical to the trust experiment, except that all subjects played the role of an investor who could transfer 0, 4, 8, or 12 MU into a project rather than to a trustee. In particular, an investor’s payoff risk in the risk experiment was identical to that in the trust experiment at any feasible transfer level.

Слайд 7

To measure alterations in the psychological state of subjects throughout the course of the experiment, we assessed their mood and calmness at the beginning of the experiment (before substance administration) and immediately before the trust experiment or the risk experiment, by means of a suitable questionnaire. Subjects received a flat fee of 80 Swiss francs for participation in the experiment; each MU earned in the trust and the risk experiment was worth 0.40 Swiss francs.

Слайд 8: M echanisms that might be involved in generating the effect of oxytocin on trusting behavior

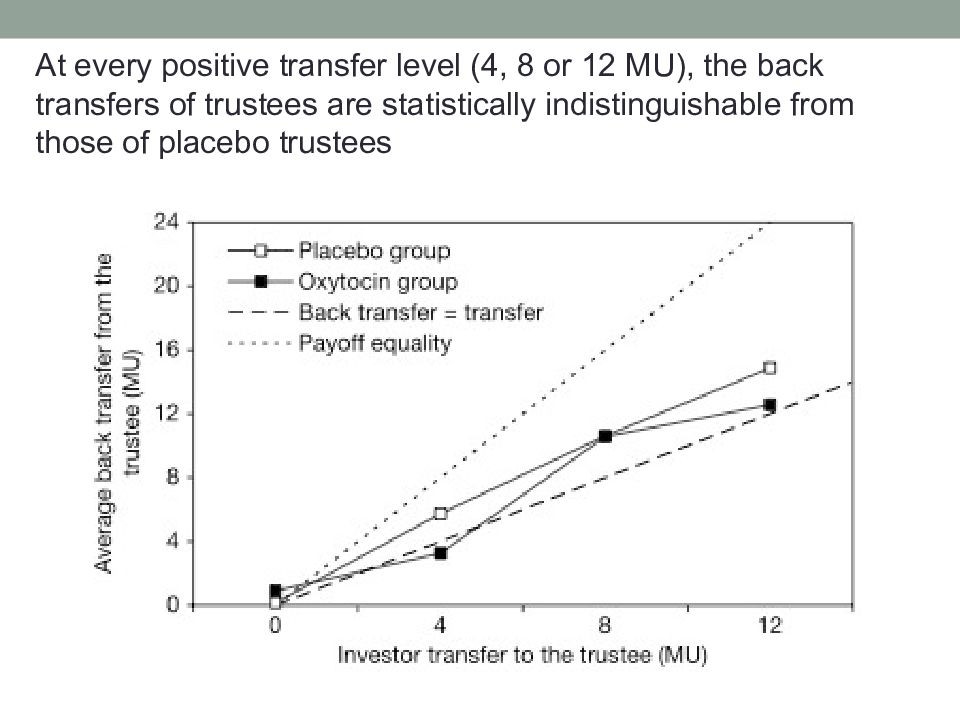

O xytocin causes a general increase in prosocial inclinations. -> oxytocin should affect the prosocial behaviour both of the investors and the trustees. Scientists predict: those trustees who are given oxytocin should make higher back transfers at any given level than the trustees who received placebo. However, trustees given oxytocin do not show more trustworthy behaviour. Result: oxytocin does not increase the general inclination to behave prosocially. Rather, oxytocin specifically affects the trusting behaviour of investors.

Слайд 9

At every positive transfer level (4, 8 or 12 MU), the back transfers of trustees are statistically indistinguishable from those of placebo trustees

Слайд 10

Scientists hypothesize: the differing effect of oxytocin on the behavior of investors and trustees is related to the fact that investors and trustees face rather different situations. I nvestors - have to make the first step; they have to ‘approach’ the trustee by transferring money. T rustees - can condition their behavior on the basis of the investors’ actions. -> The psychology of trust is important for investors, whereas the psychology of strong reciprocity27 is relevant for trustees.

Слайд 11: Second mechanism

It could be based on subjects’ beliefs. Oxytocin might render subjects more optimistic about the likelihood of a good outcome. Scientists measured the investor’s subjective expectation about the trustee’s back transfer after every transfer decision. Findings: these expectations do not differ significantly between oxytocin and placebo groups at every feasible positive transfer level ( Mann-Whitney U-test ). Thus, the investors given oxytocin show more trusting behavior but do not hold significantly different beliefs about the trustworthiness of others. Oxytocin does not affect investors’ beliefs about the likelihood of a good outcome in the risk experiment.

Последний слайд презентации: SAMPLE: Third mechanism

There is the possibility that oxytocin helps subjects to overcome their betrayal aversion in social interactions. An increase in the transfer level from 4 or 8MU to 12MU decreased the investor’s average payoff slightly, whereas it increased the objective risk of very low back transfers by the trustee. However, betrayal aversion alone cannot explain why investors given oxytocin make higher transfers in the trust experiment compared with the risk experiment, because betrayal is impossible in the risk experiment.